What's A Good Sharpe Ratio? Unlocking The Secrets Of Investment Performance

So, you're diving into the world of investments, and you've probably heard about this thing called the Sharpe Ratio. But what's a good Sharpe Ratio? Let's break it down for you, because understanding this metric is like having a secret weapon in your investment arsenal. It's not just some random number—it's a powerful tool that helps you assess how well your investments are performing compared to the risks you're taking. Stick around, because we're about to demystify this whole concept for you.

You might be wondering why the Sharpe Ratio matters so much. Well, imagine you're standing at a crossroads, trying to decide which investment path to take. The Sharpe Ratio is like your trusty GPS, guiding you toward smarter decisions. It helps you figure out whether the returns you're getting are worth the risks you're taking. And let's face it, who doesn't want to make their money work smarter, not harder?

In this article, we're going to dive deep into what makes a good Sharpe Ratio, how to calculate it, and why it’s so important for investors like you. Whether you're a seasoned pro or just starting out, this knowledge can make all the difference in building a solid investment portfolio. So, let's get started, shall we?

Understanding Sharpe Ratio: The Basics

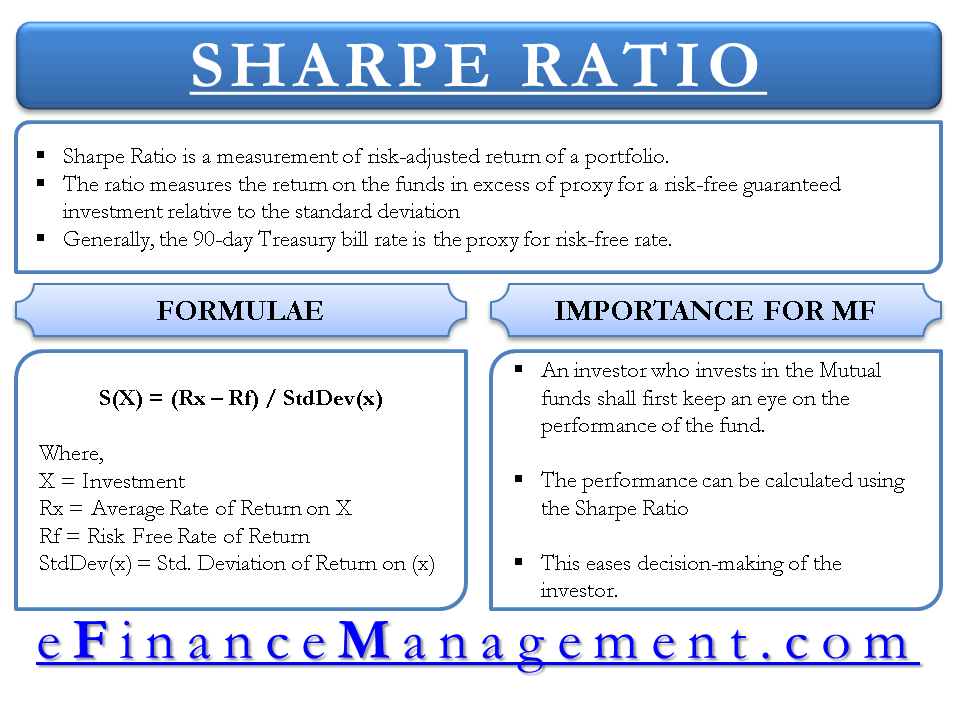

Alright, let's kick things off by breaking down what the Sharpe Ratio actually is. In simple terms, it's a way to measure how much return you're getting for every unit of risk you're taking. Think of it as a scorecard for your investments. The higher the Sharpe Ratio, the better your investments are performing relative to the risks involved.

Why Does Sharpe Ratio Matter?

Here's the deal: when you're investing, you're essentially trading risk for reward. The Sharpe Ratio helps you see if you're getting a fair deal in that trade-off. It's like asking, "Am I getting enough bang for my buck?" If your Sharpe Ratio is high, it means you're getting solid returns without taking on too much risk. On the flip side, a low Sharpe Ratio might suggest that you're taking on too much risk for the returns you're getting.

How Sharpe Ratio Works in Real Life

Let's say you're comparing two investment options. Option A has a Sharpe Ratio of 1.5, while Option B has a Sharpe Ratio of 0.8. All things being equal, Option A is the better choice because it offers higher returns for the same level of risk. It's like choosing the faster horse in a race. You want the one that's going to give you the best chance of winning.

What's a Good Sharpe Ratio? Breaking It Down

Now, let's get to the heart of the matter. What exactly qualifies as a "good" Sharpe Ratio? Generally speaking, a Sharpe Ratio of 1 or higher is considered good. Anything above 2 is excellent, and a ratio above 3 is considered exceptional. But here's the thing: what's "good" can vary depending on the type of investment and market conditions.

Sharpe Ratio Benchmarks

- Less than 1: This might indicate that the investment isn't generating enough returns to justify the risk.

- 1 to 2: This is considered a decent Sharpe Ratio, suggesting a reasonable balance between risk and reward.

- 2 to 3: This is where things start to get really good. Investments in this range are typically delivering solid returns with manageable risk.

- Above 3: Now we're talking! Investments with a Sharpe Ratio above 3 are considered top-tier performers.

Factors Influencing Sharpe Ratio

Several factors can affect your Sharpe Ratio, including market volatility, asset allocation, and the overall health of the economy. For instance, during times of economic uncertainty, even well-performing investments might see their Sharpe Ratios dip. That's why it's important to look at the Sharpe Ratio over a longer time horizon to get a more accurate picture.

How to Calculate Sharpe Ratio

Calculating the Sharpe Ratio might sound intimidating, but it's actually pretty straightforward. Here's the basic formula:

Sharpe Ratio = (Portfolio Return - Risk-Free Rate) / Standard Deviation of Portfolio Returns

Let's break that down a bit further. The "Portfolio Return" is the average return of your investments over a given period. The "Risk-Free Rate" is typically the return on a government bond, which is considered a low-risk investment. And the "Standard Deviation" measures the volatility or risk of your portfolio.

Step-by-Step Guide to Calculating Sharpe Ratio

- Calculate the average return of your portfolio over a specific period.

- Subtract the risk-free rate from your portfolio return.

- Determine the standard deviation of your portfolio returns.

- Divide the result from step 2 by the result from step 3.

Voila! You've just calculated your Sharpe Ratio. It's like solving a puzzle, where each piece fits together to give you a clearer picture of your investment performance.

Sharpe Ratio vs Other Metrics

While the Sharpe Ratio is a powerful tool, it's not the only metric you should consider when evaluating investments. Other metrics, like the Sortino Ratio and Treynor Ratio, also offer valuable insights into risk and return. So, how does the Sharpe Ratio stack up against these other measures?

Sortino Ratio

The Sortino Ratio is similar to the Sharpe Ratio, but it focuses specifically on downside risk. Instead of considering all volatility, it only looks at the negative deviations in returns. This can be especially useful for investors who are more concerned with minimizing losses than maximizing gains.

Treynor Ratio

The Treynor Ratio, on the other hand, measures returns against systematic risk, or the risk that affects the entire market. Unlike the Sharpe Ratio, which considers total risk, the Treynor Ratio focuses on the risks that can't be diversified away. This makes it a good complement to the Sharpe Ratio, giving you a more complete picture of your investment's risk profile.

Sharpe Ratio in Different Investment Scenarios

The beauty of the Sharpe Ratio is that it can be applied to a wide range of investment scenarios. Whether you're dealing with stocks, bonds, mutual funds, or even cryptocurrencies, the Sharpe Ratio can help you assess performance and risk. Let's take a closer look at how it applies in different contexts.

Stocks

When it comes to individual stocks, the Sharpe Ratio can help you identify which ones are delivering the best returns for the level of risk involved. For example, a tech stock with a high Sharpe Ratio might be worth the volatility if it's consistently outperforming the market.

Bonds

Bonds are generally considered safer investments, but that doesn't mean they're immune to risk. The Sharpe Ratio can help you evaluate whether a particular bond or bond fund is providing enough return to justify any risks it might carry.

Cryptocurrencies

Now, let's talk about the wild world of cryptocurrencies. Given their high volatility, the Sharpe Ratio can be a valuable tool for assessing whether the potential returns are worth the risks. Just be prepared for some eye-popping numbers, as the crypto market can be incredibly unpredictable.

Common Misconceptions About Sharpe Ratio

Like any financial metric, the Sharpe Ratio isn't without its critics. There are a few common misconceptions that can lead to misunderstandings about its usefulness. Let's clear up some of these myths and set the record straight.

Myth 1: Higher Sharpe Ratio Always Means Better Performance

Not necessarily. While a higher Sharpe Ratio generally indicates better risk-adjusted returns, it doesn't tell the whole story. For example, an investment with a high Sharpe Ratio might still be underperforming in absolute terms if the overall market is doing poorly.

Myth 2: Sharpe Ratio Ignores Other Important Factors

True, the Sharpe Ratio doesn't consider factors like liquidity, fees, or tax implications. That's why it's important to use it in conjunction with other metrics and analysis to get a well-rounded view of your investments.

Practical Tips for Using Sharpe Ratio

Now that you know what the Sharpe Ratio is and how to calculate it, let's talk about how you can use it in your own investment strategy. Here are a few practical tips to keep in mind:

- Compare Apples to Apples: When using the Sharpe Ratio to compare investments, make sure you're comparing similar types of assets. For example, don't compare a stock's Sharpe Ratio to a bond's Sharpe Ratio without considering the differences in risk and return profiles.

- Look at Long-Term Trends: A single year's Sharpe Ratio might not give you the full picture. Instead, look at trends over several years to get a better sense of an investment's performance.

- Combine with Other Metrics: As we've discussed, the Sharpe Ratio is just one tool in your investment toolbox. Use it alongside other metrics to make more informed decisions.

Real-World Examples of Sharpe Ratio in Action

Let's bring it all together with some real-world examples of how the Sharpe Ratio can be used in practice. These examples will help illustrate how the Sharpe Ratio can guide investment decisions and improve portfolio performance.

Example 1: Comparing Mutual Funds

Imagine you're considering two mutual funds. Fund A has a Sharpe Ratio of 1.2, while Fund B has a Sharpe Ratio of 0.9. Based on this information alone, Fund A might seem like the better choice. However, if you dig deeper, you might find that Fund B has other advantages, such as lower fees or better liquidity. This is where the Sharpe Ratio becomes just one piece of the puzzle.

Example 2: Evaluating Stock Performance

Say you're evaluating two tech stocks. Stock X has a Sharpe Ratio of 1.8, while Stock Y has a Sharpe Ratio of 1.4. While Stock X might appear to be the better investment, you should also consider other factors like market trends, company fundamentals, and economic conditions. The Sharpe Ratio is a great starting point, but it's not the final word.

Conclusion: Taking Your Investment Game to the Next Level

Alright, we've covered a lot of ground here, and hopefully, you now have a solid understanding of what a good Sharpe Ratio is and how it can help you make smarter investment decisions. Remember, the Sharpe Ratio is just one tool in your arsenal, but it's a powerful one that can provide valuable insights into risk and return.

So, what's next? Take what you've learned and start applying it to your own investment strategy. Compare Sharpe Ratios, consider other metrics, and always keep an eye on the bigger picture. And don't forget to share your thoughts and experiences in the comments below. We'd love to hear how you're using the Sharpe Ratio to level up your investment game!

Table of Contents

- Understanding Sharpe Ratio: The Basics

- Why Does Sharpe Ratio Matter?

- How Sharpe Ratio Works in Real Life

- What's a Good Sharpe Ratio? Breaking It Down

- Sharpe Ratio Benchmarks

- Factors Influencing Sharpe Ratio

- How to Calculate Sharpe Ratio

- Step-by-Step Guide to Calculating Sharpe Ratio

- Sharpe Ratio vs Other Metrics

- Sortino Ratio

- Treynor Ratio

- Sharpe Ratio in Different Investment Scenarios

- Stocks

- Bonds

- Cryptocurrencies

- Common Misconceptions About Sharpe Ratio

- Myth 1: Higher Sharpe Ratio Always Means Better Performance