Routing Transit Number PNC Bank: A Comprehensive Guide For Savvy Bankers

Ever wondered what that mysterious set of numbers at the bottom of your checks really mean? Well, my friend, you’re about to dive deep into the world of routing transit numbers, specifically those tied to PNC Bank. If you're here, chances are you've got questions—and we’ve got answers. So buckle up, because we’re about to demystify the routing transit number game for you!

Routing transit numbers, or RTNs as the cool kids call them, are like the secret codes that banks use to identify where your money is coming from or going to. For PNC Bank, this number is crucial for anyone who wants to make transactions, set up direct deposits, or transfer funds. Think of it as the GPS for your money—it ensures your cash gets to the right destination without getting lost in cyberspace.

Now, let’s be real for a second. If you’ve ever tried to set up an automatic payment or direct deposit, you know how important it is to have the correct routing number. One wrong digit, and your paycheck could end up in Timbuktu—or worse, someone else’s account. That’s why understanding routing transit numbers is not just useful, but essential for anyone dealing with PNC Bank. Let’s get started!

What is a Routing Transit Number?

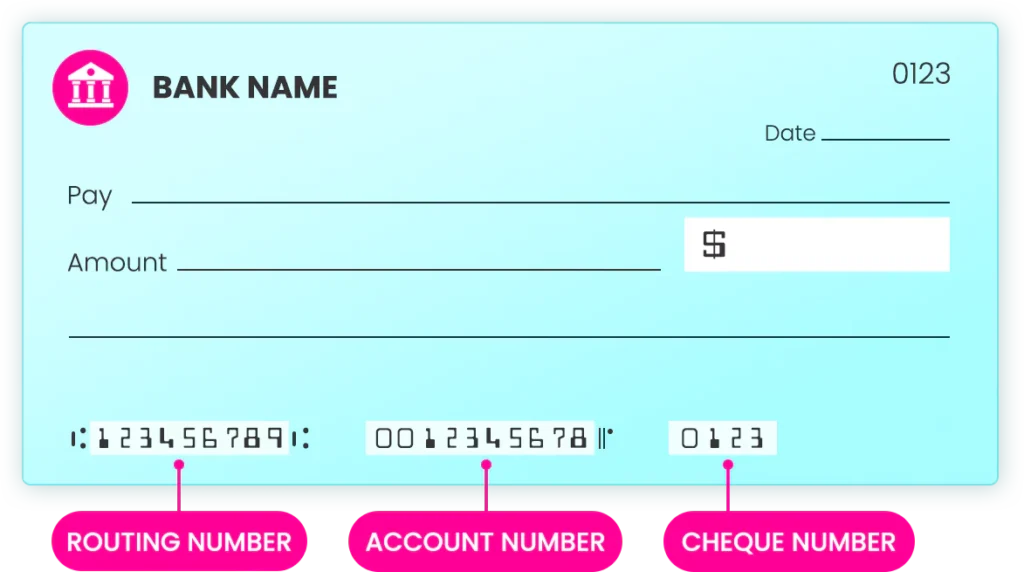

Let’s break it down nice and simple. A routing transit number is a 9-digit code that banks use to identify themselves when processing checks, wire transfers, or automatic payments. It’s basically the bank’s ID card in the financial world. Every bank has its own unique routing number, and for PNC Bank, this number varies depending on where you opened your account.

Here’s a fun fact: The Federal Reserve created the routing transit number system back in 1910, so it’s been around for a hot minute. And while technology has evolved leaps and bounds since then, the concept of routing numbers remains the backbone of our banking system.

Why is the Routing Transit Number Important for PNC Bank?

For PNC Bank customers, the routing transit number is your golden ticket to smooth financial transactions. Whether you’re setting up direct deposit for your salary, paying bills online, or transferring funds between accounts, you’ll need this number. Without it, your transactions might get delayed—or worse, rejected.

Think of it like this: If your account number is your home address, the routing transit number is the city and state. Both are necessary for ensuring your money gets where it needs to go. And just like how you wouldn’t send a letter without a proper address, you shouldn’t attempt a bank transaction without the correct routing number.

How to Find Your PNC Bank Routing Transit Number

Finding your PNC Bank routing transit number is easier than you think. Here are a few ways to track it down:

- On Your Checks: Look at the bottom-left corner of your personal checks. The first set of numbers (9 digits) is your routing transit number.

- Online Banking: Log in to your PNC Bank account and navigate to the account details section. Your routing number should be listed there.

- Customer Service: If all else fails, give PNC Bank’s customer service a call. They can provide you with the correct routing number based on your account location.

Remember, PNC Bank uses different routing numbers for different regions, so it’s crucial to confirm which one applies to your account.

PNC Bank Routing Transit Number by State

Since PNC Bank operates in multiple states, the routing transit number can vary depending on where you opened your account. Here’s a quick breakdown:

Eastern States:

- Pennsylvania: 043203034

- New Jersey: 021202190

- Delaware: 031204980

Midwest States:

- Ohio: 044000020

- Indiana: 074907915

- Kentucky: 083901627

Make sure to double-check which number applies to your specific location to avoid any hiccups during transactions.

Can You Use the Same Routing Transit Number for Wire Transfers?

Here’s where things get a little tricky. While the routing transit number works for most domestic transactions, wire transfers require a different set of numbers. For PNC Bank, the wire transfer routing number is typically 043000096. Always confirm this with your bank before initiating a wire transfer to avoid any costly mistakes.

How to Use Your Routing Transit Number Safely

Now that you know how to find your routing transit number, it’s important to use it wisely. Here are a few tips to keep your transactions secure:

- Double-Check the Number: One wrong digit can send your money to the wrong place, so take a second to verify the number before submitting it.

- Protect Your Information: Never share your routing transit number with anyone unless it’s absolutely necessary. Treat it like your Social Security number—it’s private info!

- Use Secure Platforms: When entering your routing number online, ensure the website or app is legitimate and uses encryption to protect your data.

By following these simple steps, you can safeguard your financial info and ensure your transactions go off without a hitch.

Common Issues with Routing Transit Numbers

Even the most careful bankers can run into issues with routing transit numbers. Here are some common problems and how to fix them:

Problem #1: Incorrect Number

Solution: Double-check the number against your checks or online account details. If you’re still unsure, contact PNC Bank’s customer service for clarification.

Problem #2: Delayed Transactions

Solution: Ensure you’ve entered the correct routing number and account number. If everything checks out, give it a day or two—sometimes transactions take time to process.

Problem #3: Security Concerns

Solution: If you suspect your routing number has been compromised, contact PNC Bank immediately to freeze your account and issue a new routing number if necessary.

What Happens if You Use the Wrong Routing Transit Number?

Using the wrong routing transit number can lead to several headaches. Your transaction might get rejected, delayed, or—worst-case scenario—sent to the wrong bank. This is why it’s so important to verify the number before proceeding with any financial activity.

Understanding the History of Routing Transit Numbers

Routing transit numbers have been around since the early 1900s, and they’ve played a vital role in the evolution of banking. Originally designed to streamline check processing, these numbers have since expanded to cover electronic transactions, wire transfers, and more.

Fun fact: The first digit of a routing transit number indicates the Federal Reserve Bank responsible for the region. For example, a number starting with “04” refers to the Federal Reserve Bank of Philadelphia, where PNC Bank is headquartered. Cool, right?

How Technology Has Changed Routing Transit Numbers

With the rise of online banking and mobile apps, routing transit numbers have become even more important. They’re no longer just for check processing—they’re now the backbone of digital transactions. And as technology continues to evolve, so too will the role of routing transit numbers in our financial lives.

Conclusion: Mastering the Routing Transit Number Game

There you have it—everything you need to know about routing transit numbers for PNC Bank. From understanding what they are to finding your specific number, we’ve covered it all. Remember, the key to smooth banking is accuracy and security, so always double-check your numbers and keep your info private.

Now that you’re armed with this knowledge, go forth and conquer the world of banking! And don’t forget to share this article with your friends and family so they can become routing number wizards too. Happy banking!

Table of Contents

- Routing Transit Number PNC Bank: A Comprehensive Guide for Savvy Bankers

- What is a Routing Transit Number?

- Why is the Routing Transit Number Important for PNC Bank?

- How to Find Your PNC Bank Routing Transit Number

- PNC Bank Routing Transit Number by State

- Can You Use the Same Routing Transit Number for Wire Transfers?

- How to Use Your Routing Transit Number Safely

- Common Issues with Routing Transit Numbers

- What Happens if You Use the Wrong Routing Transit Number?

- Understanding the History of Routing Transit Numbers

- How Technology Has Changed Routing Transit Numbers

- Conclusion: Mastering the Routing Transit Number Game

![Your PNC Bank Routing Number [Revealed!]](https://theblissfulbudget.com/wp-content/uploads/2022/09/pnc-bank-routing-number.jpg)