Sell Stock After Ex Dividend Date: The Ultimate Guide To Maximize Your Returns

Hey there, stock market enthusiasts! Are you scratching your head trying to figure out whether you should sell stock after ex dividend date? You're not alone. Many investors find themselves in this tricky situation, wondering how to make the best decision for their portfolios. Understanding the ins and outs of ex-dividend dates and post-dividend stock sales can be a game-changer in your investment journey.

Let me break it down for you. Selling stock after ex dividend date is a strategy that can either boost your returns or leave you scratching your head wondering what went wrong. But don’t panic! This article will guide you through everything you need to know, from the basics to advanced tips, so you can make informed decisions like a pro.

Before we dive deep into the nitty-gritty, let’s get one thing straight: this isn’t just about selling stocks. It’s about understanding the bigger picture of dividends, ex-dividend dates, and how they impact your investments. So grab your favorite drink, sit back, and let’s explore this fascinating world together.

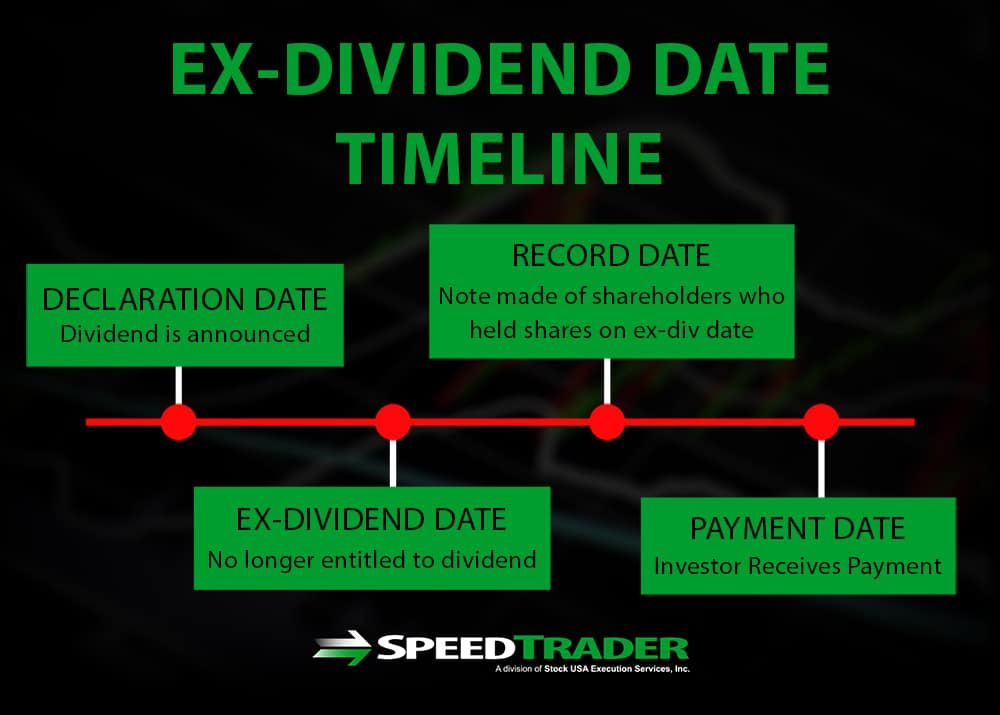

What is an Ex Dividend Date?

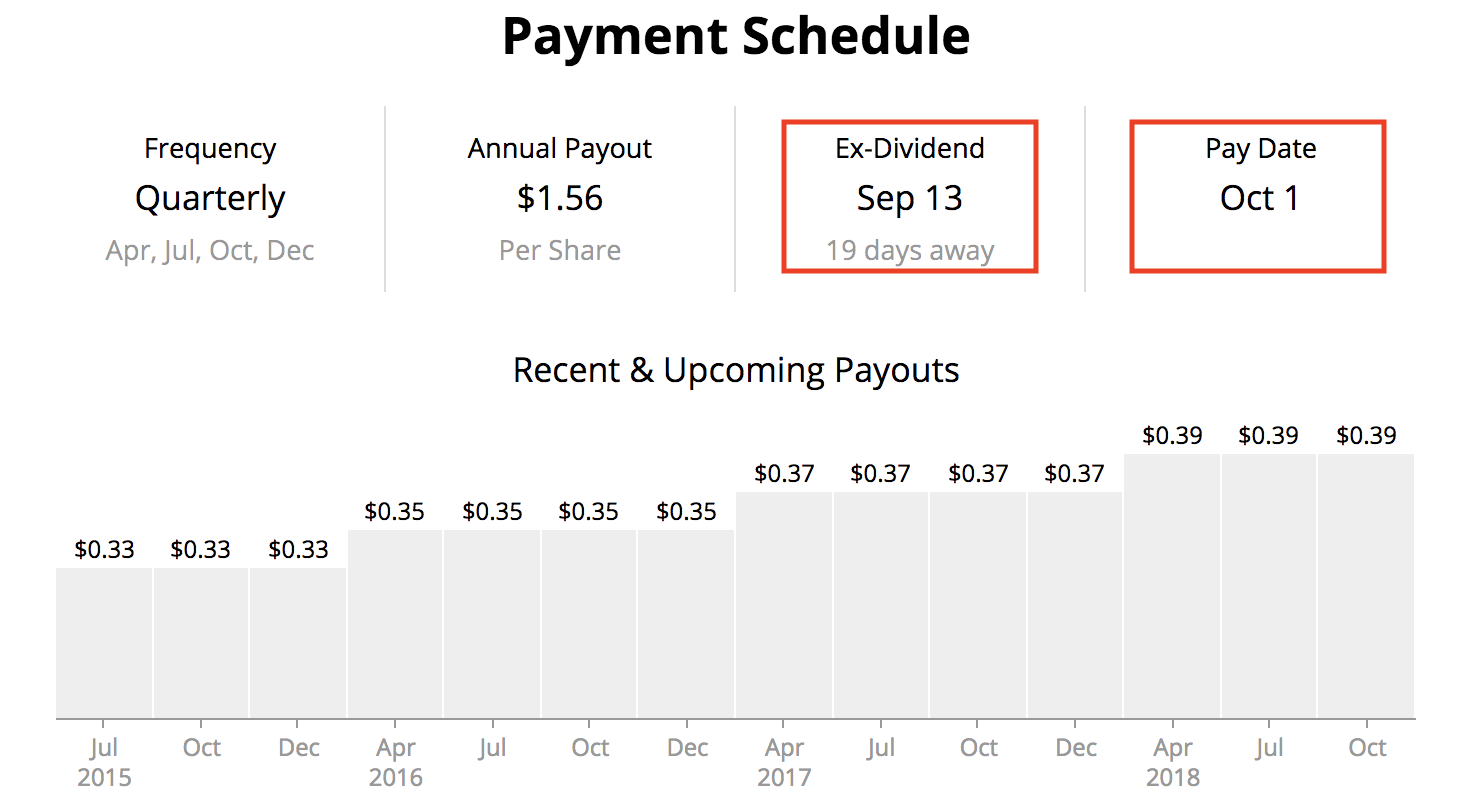

Alright, let’s start with the basics. The ex-dividend date is the date when a stock goes ex-dividend, meaning that buyers who purchase the stock on or after this date will not be eligible for the upcoming dividend payout. Got it? Good! Now, here’s the twist: the stock price usually drops by the amount of the dividend on the ex-dividend date. This adjustment reflects the fact that the company is distributing profits to shareholders.

Why Does the Ex Dividend Date Matter?

Here’s the deal: the ex-dividend date is crucial because it determines who gets the dividend. If you own the stock before the ex-dividend date, congratulations—you’re in line to receive the dividend. But if you buy it on or after the ex-dividend date, sorry pal, you’re out of luck this time around.

Should You Sell Stock After Ex Dividend Date?

This is the million-dollar question, isn’t it? Selling stock after ex dividend date can be a smart move if you’ve already locked in your dividend and the stock’s price has dropped. However, it’s not always the best decision. Let’s break it down for you:

- If the stock’s price has dropped significantly after the ex-dividend date and you believe it won’t recover anytime soon, selling might be a good idea.

- On the flip side, if you’re confident in the company’s long-term potential, holding onto the stock might be a better strategy.

- Consider your overall investment goals and risk tolerance before making a decision.

Understanding the Impact of Selling After Ex Dividend Date

Selling stock after ex dividend date can have both positive and negative impacts on your portfolio. Here’s what you need to know:

Pros of Selling Stock After Ex Dividend Date

Let’s talk about the good stuff first. Selling after the ex-dividend date can help you:

- Lock in profits if the stock’s price has dropped significantly.

- Reinvest the proceeds into other opportunities with better growth potential.

- Reduce your exposure to a stock that might underperform in the future.

Cons of Selling Stock After Ex Dividend Date

Now, let’s flip the coin. Selling after the ex-dividend date might not always be the best move. Here’s why:

- You might miss out on future gains if the stock rebounds.

- You could incur capital gains taxes if you’ve held the stock for a short period.

- You might disrupt your long-term investment strategy.

Factors to Consider Before Selling Stock After Ex Dividend Date

Before you hit the sell button, take a moment to consider these factors:

1. Company Performance

Is the company performing well? Check out the latest earnings reports, financial statements, and industry trends to gauge the company’s health. If the fundamentals are strong, holding onto the stock might be a wise choice.

2. Market Conditions

Market conditions can play a big role in your decision. Is the market bullish or bearish? Are there any economic indicators pointing to a potential downturn? Stay informed and adjust your strategy accordingly.

3. Tax Implications

Taxes can eat into your profits, so it’s important to understand the tax implications of selling stock. If you’ve held the stock for less than a year, you’ll be subject to short-term capital gains tax rates, which can be higher than long-term rates.

Strategies for Selling Stock After Ex Dividend Date

Now that you know the basics, let’s dive into some strategies for selling stock after ex dividend date:

1. Tax-Loss Harvesting

This strategy involves selling stocks that have declined in value to offset capital gains taxes. By selling after the ex-dividend date, you can lock in your dividend and still take advantage of tax-loss harvesting.

2. Rebalancing Your Portfolio

Rebalancing your portfolio is all about maintaining the right mix of assets. If one stock has grown too large in your portfolio, selling after the ex-dividend date can help you bring things back into balance.

3. Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. If you’re using this strategy, selling after the ex-dividend date can provide you with cash to reinvest in other opportunities.

Real-Life Examples of Selling Stock After Ex Dividend Date

Let’s look at some real-life examples to see how selling stock after ex dividend date can play out:

Example 1: Tech Giant Stock

Imagine you own 100 shares of a tech giant that pays a $2 dividend per share. The ex-dividend date is tomorrow, and you’re considering selling. After the ex-dividend date, the stock price drops by $2 per share, but you’ve already locked in your dividend. If you believe the stock won’t recover anytime soon, selling might be a smart move.

Example 2: Dividend Aristocrat

Now, let’s say you own shares of a dividend aristocrat with a long history of increasing dividends. The ex-dividend date is approaching, and you’re thinking about selling. However, after analyzing the company’s fundamentals and market conditions, you decide to hold onto the stock, confident in its long-term potential.

Common Mistakes to Avoid When Selling Stock After Ex Dividend Date

Mistakes happen, but they can be costly in the stock market. Here are some common mistakes to avoid:

- Selling without a clear reason or strategy.

- Ignoring tax implications and incurring unnecessary costs.

- Letting emotions drive your decisions instead of logic and analysis.

How to Make Informed Decisions About Selling Stock After Ex Dividend Date

Making informed decisions is key to successful investing. Here’s how you can do it:

1. Stay Informed

Keep up with the latest news, earnings reports, and market trends. Knowledge is power, and the more informed you are, the better decisions you’ll make.

2. Develop a Strategy

Whether it’s tax-loss harvesting, rebalancing, or dollar-cost averaging, having a strategy in place will help you navigate the complexities of selling stock after ex dividend date.

3. Consult a Financial Advisor

If you’re unsure about your decision, don’t hesitate to consult a financial advisor. They can provide personalized advice based on your unique situation and goals.

Conclusion

Alright, we’ve covered a lot of ground here. Selling stock after ex dividend date can be a powerful tool in your investment arsenal, but it requires careful consideration and a solid strategy. Remember to:

- Understand the ex-dividend date and its impact on stock prices.

- Consider factors like company performance, market conditions, and tax implications.

- Develop a strategy that aligns with your investment goals.

So, what’s next? Take action! Whether it’s selling, holding, or exploring new opportunities, the choice is yours. And don’t forget to share your thoughts in the comments below or check out our other articles for more insights. Happy investing, and may the market be with you!

Table of Contents:

- What is an Ex Dividend Date?

- Should You Sell Stock After Ex Dividend Date?

- Understanding the Impact of Selling After Ex Dividend Date

- Factors to Consider Before Selling Stock After Ex Dividend Date

- Strategies for Selling Stock After Ex Dividend Date

- Real-Life Examples of Selling Stock After Ex Dividend Date

- Common Mistakes to Avoid When Selling Stock After Ex Dividend Date

- How to Make Informed Decisions About Selling Stock After Ex Dividend Date

:max_bytes(150000):strip_icc()/Ex-Dividend-73326ee2cff9411dbe8504bf434bbe3b.jpg)